Menu

| Properties | > | Owner Distribution Profile |

Mandatory Prerequisites

Prior to creating an Owner Distribution Profile, refer to the following Topics:

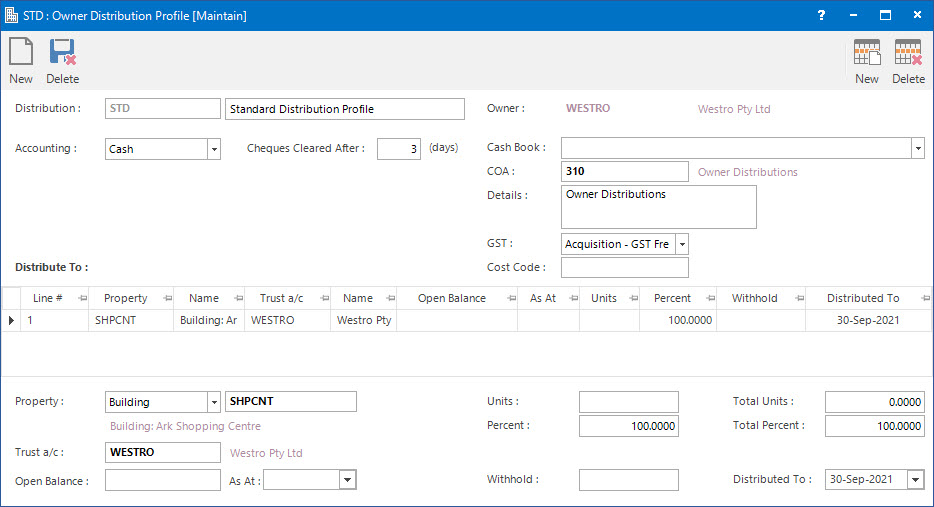

Screenshot and Field Descriptions

Distribution: this is the primary identifier for the Owner Distribution Profile.

Name: this is the friendly name given to the Owner Distribution Profile.

Accounting: this is the type of accounting method that the profile is set up for. The options are:

- Accrual: in this accounting method the distributions are based on invoiced amounts.

- Cash: in this accounting method the distributions are based on the amounts received.

Cheques Cleared After: this is the number of days to allow cheques to be cleared at the bank. This option is only available for Cash accounting.

Cash Book: this is the Bank account if the transactions raised are going to be a Cash Sales / Cash Credit type transaction. Leave blank if a Invoice / Credit Note type transaction is to be raised.

COA: this is the Chart of Account for the transactions to be raised.

Details: this is the description for the transactions. It will default to the value set up for the COA.

GST: this is the GST Type for the transactions. It will default to the type set up for the COA.

Inclusive: this check box determines if the Amount includes GST. If this field is ticked, when the GST is calculated, the Amount will be reduced by the GST and the tick will disappear to reflect that the line no longer includes GST. If this check box is not ticked, the Amount will not be reduced and the GST will be calculated normally.

GST From: this is a historical field and current use is now irrelevant. It was used during the implementation of GST to allow contractual date based transactions to escape full GST. There may be old transactions on the system to which the rule applied.

Cost Code: this is the cost centre that the amounts relate to. This field can be set as optional, mandatory or not required on the COA set up screen.

Distribute To table: this table displays the owned Properties and percentage split of the distributed funds to the Trust accounts.

Property: this is the Property related to the Trust account.

Trust a/c: this is the Trust account that has a percentage ownership in the Owning Entity, to which the profile is attached. The Owner Distribution process will create an Invoice or Cash Sale transaction to this account.

Open Balance: this is the opening balance to enter for the Trust account.

As At: this is the date of the Owner Distribution starts from.

Units / Percent: this is the percent of ownership in the Owning Entity. If a Unit value is entered the Percent field will automatically calculate.

Withhold: this is the amount to be withheld from the Distribution.

Total Units / Total Percent: this is the total number of percent of ownership in the Owning Entity. If a Percent value is entered, the Total Percent field will be automatically calculated.

Distributed To: this is the date that distributions have been made to. This field will be updated when the Owner Distribution Final process is run or can also be manually entered if required.

How Do I : Add a new Owner Distribution Profile

How Do I : Modify an existing Owner Distribution Profile

Modifying an existing Owner Distribution Profile will not change the Owner Distribution instances that have already been created against the Owner. The changes will only affect new Owner Distribution entries you create subsequent to the Owner Distribution Profile changes. If you need to change existing entries, these will need to be done individually.

How Do I : Delete an existing Owner Distribution Profile

Deleting an existing Owner Distribution Profile will not delete the Owner Distribution instances that have already been created against the Owner. If you need to delete existing entries, these will need to be done individually.

Owner Distribution Profiles are associated with the following Topics: